axiapac Lean Accounting allows you at the click of button to send an electronic sales invoice that is almost instantly received by your customer into their accounting system. Purchase invoices can be received electronically, without touching your keyboard, just waiting for your approval.

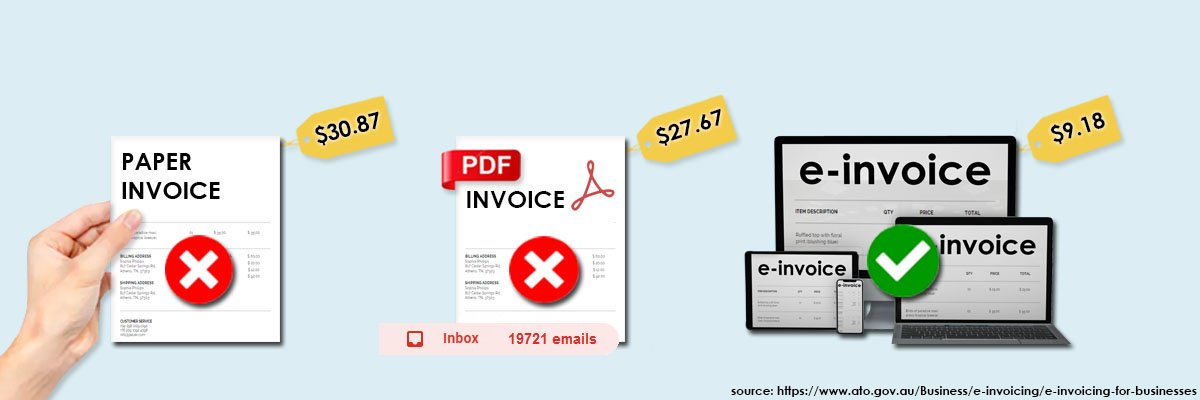

Sending an e-Invoice to your B2B Customer has many lean benefits which ultimately mean you get paid faster.

- you save your customers time as they do not need to key-in your sales invoice into their accounting system

- no more emailing invoices to customers that get lost, go to junk or get overlooked

- eliminate the wrong invoice amounts input and paid by your customers and wasted communications in fixing these problems

- e-Invoices must be paid within 5 days by Australian Government departments

Receiving Purchase Invoices directly into your accounting software can pose problems but axiapac uses artificial intelligence and machine learning to further reduce the need for human processing.

- matching order line items and quantity, including product number and part descriptions with your purchase orders

- allocating line items, quantities, hours and costs against the right Job, Project or Stock Location

- posting costs to the correct General Ledger Accounts and Value Streams

- the majority of purchase invoices involve just a one-click approval step

axiapac Lean Accounting cloud software as a service (SAAS) is fully compliant with the Peppol e-Invoice network endorsed by the Australian Federal government and administered by the Australian Taxation Office. As part of the Digital Business Plan the government announced the Commonwealth will mandate e-invoicing for all agencies by 1 July 2022, with over 80% of invoices being able to be received electronically by 1 July 2021. It will also consult on options for mandatory adoption of e-invoicing across all levels of government and by businesses.

Reduce Overhead Costs and Save Time, get axiapac e-Invoicing Today